Blogs

Starting account in the various other branches of the same bank claimed’t boost your insurance coverage. Certain loan providers provide extended FDIC insurance rates thanks to their particular mate bank sites. For example, SoFi Bank provides as much as $3 million within the security by the automatically distributing dumps around the the community out of partner banking companies. IntraFi Dollars Service (ICS) and you can Certificate of Deposit Membership Registry Solution (CDARS) is points provided due to IntraFi, with a network away from banking companies you to pass on your bank account round the several financial institutions to be sure you’re adequately shielded. This service works with checking profile, currency industry account and you can Cds. If you’d like to bequeath your money to grow your FDIC exposure, lender sites render a method to take action as opposed to banking institutions dealing with several account your self.

- When you are borrowing unions commonly protected by FDIC insurance coverage defenses, he could be nonetheless protected.

- A landlord could keep the deposit money for rental for those who moved away as opposed to giving best created observe.

- Make the produced pub password to help you an actual area which have PayNearMe characteristics including Loved ones Dollar or 7-Eleven.

- An investment regarding the financing isn’t covered otherwise secured by the the brand new Government Put Insurance coverage Corporation and other regulators agency.

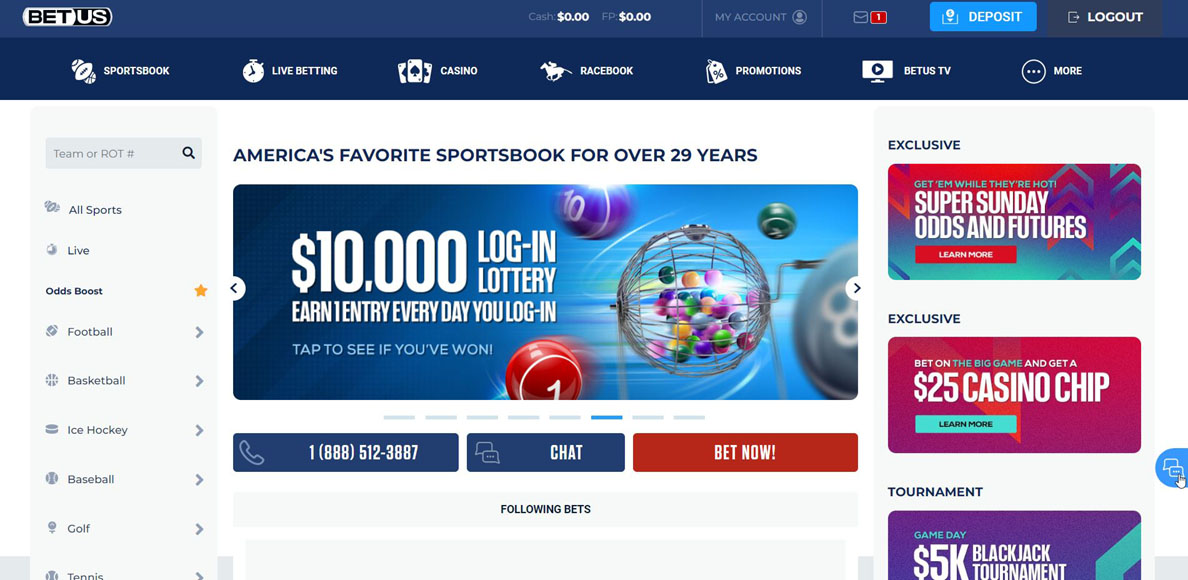

they Gambling establishment – Finest Bitcoin step 1 Buck Deposit Gambling enterprise Incentive

Once you subscribe Chance Gold coins, the new Gold Money packages try unlock for purchase. The smallest offer can cost you $5 and provide you one million Gold coins and you can 515 Chance Coins. This is a rather a good purchase price and adds quite a bit from coinage for you personally. As opposed to additional Social Casinos you’ll read about in this article, Risk.united states Casino merely accepts cryptocurrency as a method from fee. Various kinds cryptocurrency are approved, however, you’ll have lots of choices available if you have a good crypto purse. Risk.united states Casino have several Gold Money packages available for purchase.

That it do need some research basic to find the correct lender. Such, for individuals who’lso are searching for discounts membership, you’d should contrast interest rates and charge during the various other financial institutions. On line banks usually offer large APYs in order to savers minimizing costs, compared to old-fashioned stone-and-mortar banking companies. When you are an associate from LuckyLand Ports, you can earn SCs and Coins daily by signing inside the. Include also larger degrees of virtual currency by searching for to find a gold Coin plan.

Why Spotlight Financial?

You can not only take pleasure in Western european https://happy-gambler.com/casumo-casino/ Roulette, but the majority of other forms and you will variations too. There’s no limit on the offered bonuses during the $step one casinos as they likewise have free revolves to the current games, suits incentives which have advanced conditions and terms. In addition, you can also anticipate advanced benefits away from respect software, VIP profile and more! This will depend to your $step one gambling establishment you select because they all cater to additional player desires.

The newest 2008 improve are the original while the Higher Anxiety to help you occur in reaction to an intense monetary emergency. Congress very first meant it to help you last merely so long as the fresh danger of extensive financial failures, but you to wasn’t as. The newest Dodd-Frank Operate from 2010, a banking change and individual security bundle introduced to help you prevent an excellent repeat of the GFC, made the brand new $250,one hundred thousand restrict permanent. Congress didn’t should allow the freshly authored FDIC an empty look at or encourage irresponsible behavior, so it lay strict limitations on the amount shielded.

Some associations have started to provide as much as $3 million out of FDIC insurance.

- Important info in the procedures to own opening a new membership.

- To own purposes of that it paragraph “seasonal fool around with or local rental” mode fool around with or leasing for a phrase out of not more than 125 successive weeks to possess home-based intentions from the a guy having a great permanent host to home someplace else.

- For those who’re offered opening a cards partnership account, address it exactly the same way you might a bank checking account.

- Thankfully, the brand new FDIC strolled within the and you can made sure one to even though many financial group forgotten their perform, zero depositors forgotten one insured money.

- Your own statements, put slips, and you may terminated inspections are not sensed put account details.

- This means evaluating the brand new charges you may also pay and the attention you might earn, and also other have such online and cellular banking accessibility or even the size of their Atm system.

Financing One Bank isn’t accountable for any damage or liabilities through the end of an account matchmaking. At the mercy of any rights we may have with regards to improve find out of withdrawal out of your membership, you could close your account when and for people reason. In case your membership is overdrawn when we intimate they, your agree to promptly pay all numbers owed in order to you. The new FDIC contributes together with her all deposits inside old age accounts in the list above belonging to a similar person in one insured lender and you may ensures the amount up to a total of $250,100. Beneficiaries is going to be titled in these account, however, that will not add more the brand new put insurance policies visibility.

For many who withdraw away from a good Computer game earlier develops, the newest penalty is usually comparable to the level of desire attained while in the a particular time frame. As an example, a bank can get impose a penalty away from ninety days out of easy focus on the a single-seasons Computer game for individuals who withdraw away from one Computer game through to the year is actually upwards. While the certain steps can differ because of the Atm server and you may financial, of numerous go after a similar buy away from operations. Let’s walk through some of the concepts of a typical bucks put and check out particular factors to consider along how.

We’ve applied our sturdy 23-step comment way to 2000+ gambling enterprise ratings and you will 5000+ incentive also provides, making certain i identify the new trusted, safest programs with actual added bonus well worth. There are even AGCO registered and controlled $1 min deposit casinos to have Ontario in the 2025 and you may all of our faithful webpage to own Ontario provides everything participants will need as well as a summary of the major ten Ontario casinos where you are able to wager merely a dollar. There are many reasons someone like a casino which have a-1 money minimum put.

The retailer could possibly get request a preauthorization to the transaction. If you demand me to search and you will/or duplicate many information (comments, inspections, places, withdrawals, etcetera.) we may ask you for, and you also invest in spend which commission. Should your questioned fee are higher, you’re expected to pay the cost in advance.

More on-line casino resources

Cutting edge Federal Currency Industry Finance are a shared money that can be eligible for SIPC protection. However, while they’re different varieties of items, the cash they give could be additional. For additional considerations, make reference to the brand new Innovative Financial Sweep Points Terms of service (PDF). Fortunately that you don’t have to chance which have uninsured places. Banks and you will credit unions render numerous a method to design your own accounts to ensure all of your money is secure. The new FDIC coverage try $250,one hundred thousand full for everyone solitary accounts owned by a comparable people in one covered lender.

By the setting up numerous beneficiaries to suit your membership, you can boost your FDIC publicity so you can $step one.twenty five million in total. As well as, take the time to review your account stability as well as the FDIC regulations one to implement. This can be particularly important and in case there has been a large improvement in your life, for example, a death from the members of the family, a breakup, or a huge deposit from your home sales. Any of those situations you may place several of your money over the new federal restrict. When you set up a revocable faith account, you usually signify the cash often admission in order to entitled beneficiaries through to their demise. I’ve been your own money author and you may publisher for more than twenty years dedicated to currency government, deposit account, paying, fintech and you can cryptocurrency.